Basic payroll calculations

But doing payroll yourself likely means you dont have someone to check your calculations. This Payroll course is a comprehensive instructor-guided course designed.

Pin On Raj Excel

Changes to SUI Gross and SUI Taxable Calculations.

. Enhanced Payroll completes these federal payroll tax forms for you. Deleting Pending File Transactions. Federal government websites often end in gov or mil.

Access your employee payslips salary and tax declarations calculations and compliance payments. Payroll Online - RazorpayX Payroll is the best payroll software in India that automates salary disbursement in just 3 clicks. Payroll calculations usually constitute 4 main components Basic pay Allowances Deductions and IT Declarations.

Find out why at our blog. VRS Hybrid Opt-in for Plan 1 State Employees. Though there are other tools for basic calculations but standoff of using excel is its flexibility and the perception for the viewer it gives.

The market RazorpayX Payroll is the most suitable for startups as it is extremely cost-effective and easy to use. A computer system is a complete computer that includes the hardware. Its basic plan is free and the pro plan costs as low as Rs.

Calculate paychecks and taxes Get automatic tax calculations on every paycheck. Their job involves handling large sums of money on a daily basis to ensure that employees are paid accurately and on time. If you have payroll experience and need a quick refresher this first set of steps can be a quick.

Timely payment also ensures full credit against the employers Federal Unemployment Tax. Well monitor and update federal and state taxes so you dont have to. The law requires that payroll taxes must be withheld from an employees paycheck.

This is a factor used in reserve ratio calculations. These calculators include macros for printing worksheets adjusting display size and quitting or exiting the calculator. Issues Requiring Special Attention.

AutoCount Cloud Payroll HR is a comprehensive online cloud payroll HR solution which built for Malaysian SMEs. Full-service payroll available in all states. Upon processing your first payroll you can use Wave Payroll for up to 30 days commitment-free.

Dont let confusion deter you from hiring out of state employees. Think of these basic steps as a roadmap for your payroll process. And professional-grade payroll software will help you keep track of all tax-related calculations.

Payroll Developing Team based on New Tax Rates 2021 Simple Basic to NetSalary Calculator Basic Salary. Its basic plan is. You dont have to pay a professional or purchase a program.

Paid plans are slightly more affordable than the likes of QuickBooks Payroll although it doesnt have as rich a feature profile. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Software needs. The market RazorpayX Payroll is the most suitable for startups as it is extremely cost-effective and easy to use.

Learn how to calculate and report deductions. Automated tax and forms Federal and state payroll taxesincluding year-end. Before sharing sensitive information make sure youre on a federal government site.

A payroll administrator like accountants hold a crucial role within every organisation. The Basic Formula for Net Pay. Developing a Basic In-House Training Program.

The gov means its official. Average Taxable Payroll Prior 3 years Reserve Ratio. Net Salary Simple Net to Gross Salary Calculator Net Salary.

TDS is calculated on Basic Allowances Deductions 12 IT Declarations Standard deduction Standard deduction 50000. The full-service payroll automates calculations and files your federal state and local payroll taxes. Gross Salary Basic Salary Calculate Gross Salary.

With the simplified payroll HR workflow we strive to provide the users with a seamless experience in handling their leave application claims submission PCB submission and many more. Browse professional Payroll courses and improve your career prospects with reedcouk the UKs 1 job site. Doing payroll by hand is the least expensive payroll option.

From making complex calculations to processing payments within strict deadlines this is a challenging demanding and fulfilling role. Get the latest financial news headlines and analysis from CBS MoneyWatch. For instance we can add two numbers in the calculator as well but the numbers mentioned in the excel sheet can be entered in two cells and used for other functions as well subtraction division etc.

Starting at 6. Try our free HR Payroll Pro Plan for a month. Basic reports included at all tiers.

And you can use a payroll software with multi-location functionality to make sure all payroll calculations and deposits are correct. Payroll course covers everything on Payroll management thoroughly from scratch so you can achieve basic skills knowledge and Payroll functions in details. One of the most.

For state forms not yet supported we provide a State Tax Summary report with all the payroll data you need. For security reasons these macros are often disabled by default settings on the users computer. SurePayroll offers a range of convenient features including auto-payroll same-day payroll and a mobile app.

At any time you can activate to start your billing cycle and gain access to items like tax filing and approving payrolls beyond the current month. In simplest terms the basic formula for net pay works like this. Enhanced Payroll includes many state forms.

Integrate HR and Payroll with RazorpayX Payroll Software. When you manually run payroll you have full control over your payroll. You can learn the basics of how to handle payroll taxes for out-of-state employees.

Fast unlimited payroll runs QuickBooks Online Payroll lets you view and approve employee hours and run payroll in less than 5 minutes. Basic payroll processing steps. W-2 W-3 940Schedule A 941Schedule B 944 945a 943943a 1099-MISC and 1096.

Example 10000 - 6000 10 or 100 Reserve Ratio 40000. Every Business Needs to Process Payroll. You know when and how your payroll is completed.

Contact your payroll coordinator before submitting payroll as there may be special forms required for your project particularly if working with minors or non-union employees but in most cases the standard payroll paperwork includes-W4 Form-I9 Form-Employee timecard or Union time sheet-Copies of employment contracts-Check authorization forms. Payroll Processing Calendar Year End 2017. A computer is a digital electronic machine that can be programmed to carry out sequences of arithmetic or logical operations computation automaticallyModern computers can perform generic sets of operations known as programsThese programs enable computers to perform a wide range of tasks.

The basics of payroll taxes for out of state employees. It may appear like something is wrong with the online payroll tax calculations.

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Shortcuts

Pin On Excel Project Management Templates For Business Tracking

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Worksheet Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Creating Salary Details For Employee Group Payroll In Tally Erp 9 Data Migration Payroll Salary

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

Payslip Template For Excel And Google Sheets Templates Accounting Basics Excel Templates

Download Salary Sheet Excel Template Exceldatapro Excel Templates Payroll Template Worksheet Template

Salary Increase Template Excel Compensation Metrics Calculations Salary Increase Business Budget Template Excel Budget Template

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll

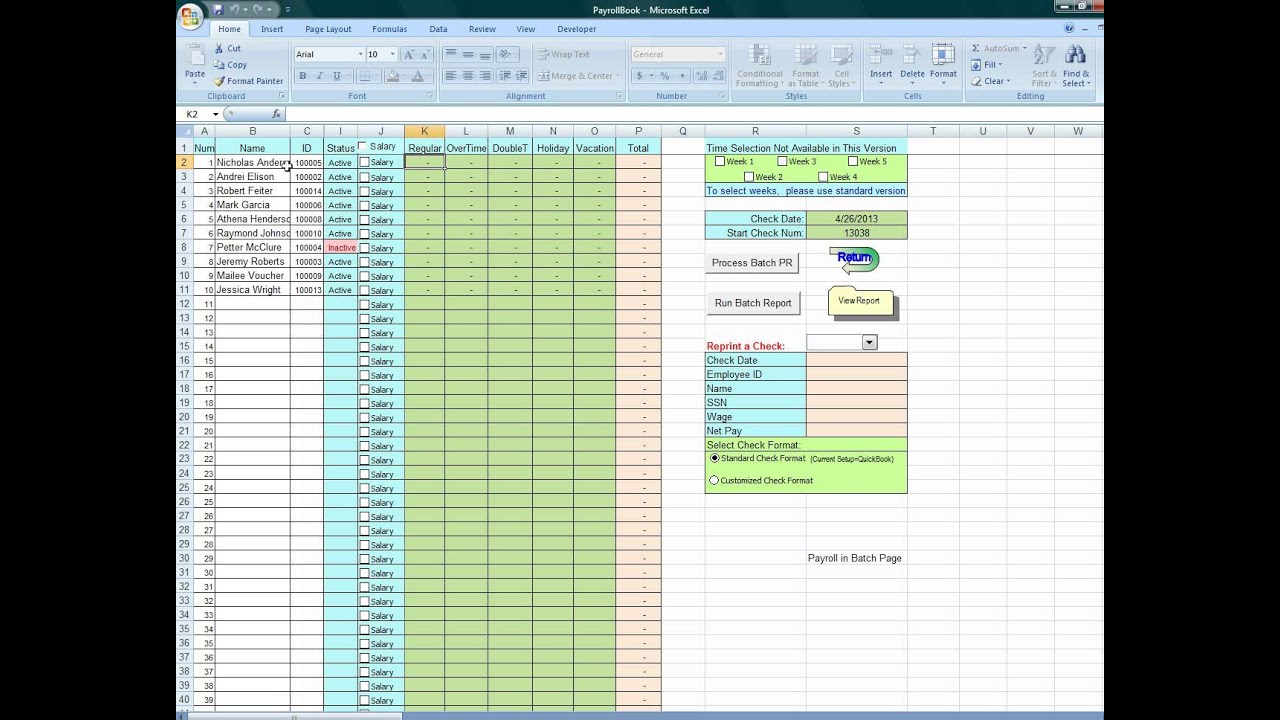

Using Excel To Process Payroll Dyi Excel Excel Calendar Template Payroll

Self Employment Ledger Forms Beautiful Printable Payroll Ledger Payroll Payroll Template Bookkeeping Templates

Step By Step How To Calculate Payroll Hours Payroll Calculator Time Management

How To Calculate Your Net Salary Using Excel Salary Excel Ads

How To Prepare Payroll In Excel This Wikihow Teaches You How To Calculate Payroll For Your Employees In Microsoft Excel Creating A Payro Payroll Excel Salary

9 Ready To Use Salary Slip Excel Templates Exceldatapro Excel Templates Payroll Template Salary

Komentar

Posting Komentar